While numbers are important, the process drives better decisions and fosters accountability. When stakeholders https://holycitysinner.com/top-benefits-of-accounting-services-for-nonprofit-organizati/ understand not just what’s being spent but also why and how decisions are made, it cultivates a culture of ownership. Partner with Jitasa to create accurate, actionable budgets for your nonprofit. This fully customizable template also includes a year-total-to-date cell, which enables you to factor in the difference between income and expenditures in order to determine how over or under budget you are. A budget for non-profit organizations should function as a living document, not a set-and-forget plan.

Operating budgets vs. program budgets 🤔

This alignment helps create more accurate forecasts and smoother cash flow management. Once you have a general idea of how much money you need to bring in, you can start to develop a budget. If you don’t have a fundraising history to work from, you can use a fundraising goal as a starting point. This can be based on the amount of money you need to raise to cover your expenses, or it can be a specific dollar amount that you would like to raise.

Importance of Budgeting for Nonprofits

Nonprofits and charities are subject to the rules and laws that govern them, and for compliance reasons, volunteer boards must practice good financial practices. This good financial management falls under the duty of care, another aspect of fiduciary responsibility. Every organization will have a unique budgeting process based on its current structure and financial status. With a more inclusive and thoughtful budgeting process, you can build a shared understanding among staff, the board, and community members, which will strengthen the connection between budget and mission.

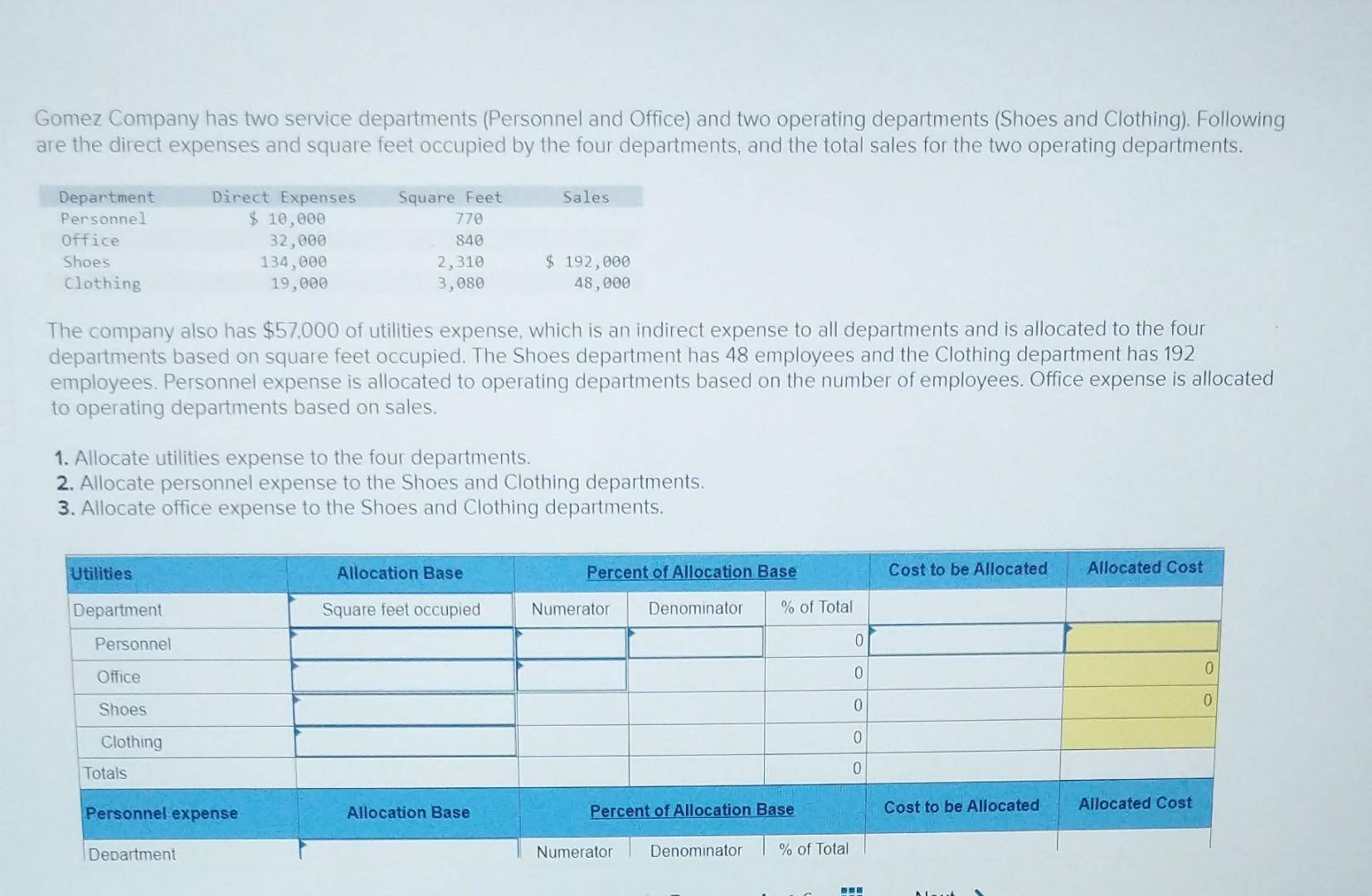

Differentiate Between Program and Operational Costs

Award-winning online accounting software designed for small business owners and accountants. Your budget is full of a lot of information, but it doesn’t accounting services for nonprofit organizations have to be overwhelming. Go one category at a time, and don’t panic about getting overly detailed. You want your budget to be a useful tool, not something you’re too intimidated to look at. Get an idea of who the granting bodies are, who they typically choose to support, and how much funding they have to offer. When it comes to planning an event, executing it successfully depends on how prepared you are!

How to determine nonprofit income for a budget?

- Track your organization’s financial performance against the budget throughout the year, making adjustments as needed to respond to changing circumstances.

- Proper budgeting can help make sure you use resources effectively, prevents overspending and ensures the financial health of your organization.

- Finally, the board or budget committee should be ready to present the annual budget to any necessary committees and the board for final approval.

- Organizations that are most successful with budgeting are those that spend the time and effort to manage the budget process and generate a realistic and usable budget that is understood by the entire staff.

Seeing these things side by side gives you the tools to decide how you can best use your resources. Your nonprofit budget is meant to be a flexible document that changes as your circumstances do. After all, sometimes you have a boost in revenue, or get hit with a pesky unexpected expense.

- They also have a plan in place to monitor their financial performance and make adjustments as needed.

- Different grants come with unique conditions and reporting requirements.

- Budgets form the basis for boards to make better decisions and to avoid making mistakes.

- A budget describes your project in numbers just as a proposal describes it in words.

- Track expenses, allocate funds, and maintain financial control with our customizable template and formulas.

Nonprofits often rely on unpredictable funding streams such as donations, grants, and seasonal fundraising campaigns. This unpredictability can make it difficult to maintain a consistent income flow, leading to challenges in long-term planning and resource allocation. Here’s a comprehensive, step-by-step guide to building a budget that supports your nonprofit’s mission effectively. Limelight empowers nonprofits with thoughtful solutions, including extensive integrations, advanced financial modeling, and precise reporting analytics—all within a user-friendly interface.

This helps get their buy-in to the process and encourages them to work within the budget once it’s approved. There’s no perfect list of items to include in your budget and every nonprofit is different. If your nonprofit is new, you’ll need to use estimates for your first budget. Start early and give yourself plenty of time to gather data, think, plan, and put everything on paper.